Find the best AI crypto arbitrage trading tools in 2025. See how AI bots increase profits, minimize risks, and automate trade strategies and receive complete information on crypto arbitrage

The crypto market is always on the move. The prices of Bitcoin, Ethereum, and thousands of altcoins can change in a matter of seconds. This unending movement presents chances for traders to gain profit—particularly via crypto arbitrage trading. However, with human capacity, it’s almost impossible to capture every opportunity by hand. That’s when AI-driven arbitrage tools become necessary. These tools leverage machine learning, live data monitoring, and automatic execution to maximize potential profits while minimizing risks.

In this guide, we’ll demystify everything you should know about AI crypto arbitrage trading tools. We’ll explain how they work, their advantages, pitfalls, and the most optimal strategies for 2025. At the end, you’ll know how to harness the power of AI in achieving a significant edge in the competitive crypto space..

What is crypto Arbitrage Trading?

Crypto arbitrage trading is the activity of buying a crypto currency at one exchange where the price is low and selling at another exchange where the price is high. The profit is derived from the price difference, also referred to as the “spread. “For instance:

Bitcoin is priced at $25,000 at Exchange A.

The same Bitcoin costs $25,200 at Exchange B.

A trader can purchase 1 BTC from Exchange A and sell it at Exchange B, gaining a $200 profit (less commission).

Sounds easy, doesn’t it? The problem is that these opportunities evaporate in seconds. That’s why AI tools are the game-changers—they spot and carry out these trades in seconds.

Why Use Ai For Crypto Arbitrage

Human traders can’t keep track of hundreds of exchanges, thousands of trading pairs, and infinite price movements simultaneously. AI tools can, though:

Watch thousands of trades per second on multiple exchanges.

Identify arbitrage opportunities immediately before they are gone.

Execute trade automatically to eliminate delay due to human reaction time.

Eliminate emotional trading, adhering to data-driven plans.

Learn and evolve based on machine learning models to become more accurate with time.

In short, AI does not only save time but also boosts profit potential and minimizes risks.

How AI Tools Work in Arbitrage Trading

AI-powered arbitrage tools follow a systematic process:

1. Real-Time Data Collection

- AI algorithms continuously monitor various exchanges for changes in price. They utilize APIs to gather:

- Order book data

- Trade history

- Volume and liquidity

- Fees and transaction times

2 Pattern Identification

Machine learning algorithms identify trends in prices, market inefficiencies, and persistent arbitrage situations.

3 Automated Execution

After identifying an opportunity, the AI automatically performs trades within milliseconds.

4 Risk Management

AI robots are designed with risk management features such as:

Placing stop-loss orders

Steering clear of illiquid exchanges

Including transaction and withdrawal charges

5 continuous learning

5 Continuous Leering

Sophisticated AI software utilizes feedback loops, refining their tactics with each transaction.

Types of Crypto Arbitrage Strategies Powered by Ai

AI software is non-discriminatory. They don’t only search for price discrepancies—they maximize various strategies, such as:

1. Spatial Arbitrage

Purchase on a single exchange and sell on another. Example: Purchase ETH on Binance, sell on Kraken.

2. Triangular Arbitrage

Taking advantage of differences in price between three pairs within the same exchange. Example: BTC → ETH → USDT → BTC.

3. Statistical Arbitrage

Employing AI and quantitative models for forecasting short-term mispricing and trading accordingly.

4. Cross-Border Arbitrage

Selling a crypto asset in one region and buying it in another based on regional disparities in demand, regulation, or currency fluctuations.

5. Decentralized Arbitrage (DeFi)

Utilizing price differentials across decentralized exchanges (DEXs) through AI-based smart contracts.

Benefits of AI Tools in Arbitrage Trading

AI arbitrage bots provide the trader with various benefits:

Speed: AI responds in milliseconds—far quicker than traditional trading.

Accuracy: Complex algorithms eliminate human mistakes.

24/7 Trading: AI does not sleep, taking advantage of opportunities all day and night.

Scalability: Trade across many exchanges and assets at once.

Emotion-Free Decisions: Trades are made on logic, not fear or greed.

Risks of AI in Arbitrage Trading

Although AI technology is capable, it is not riskless. Some of the common issues are:

Transaction Fees: Steep fees can drain profits.

Latency: Delays in networks might lead to lost opportunities.

Liquidity Issues: Low-volume markets might make it difficult to implement trades.

Regulatory Risks: Various nations have varying regulations regarding crypto trading.

Software Bugs: Even AI robots are susceptible to malfunctioning if they are not regularly updated.

Featured to Look for in an Ai Crypto Arbitrage Tool

When selecting an AI arbitrage platform, look for the following essential features:

Multi-exchange integration

Support for high-frequency trading

Sophisticated risk management features

Adjustable strategies

Clearly defined fee structure

Easy-to-use dashboard

24/7 customer support and

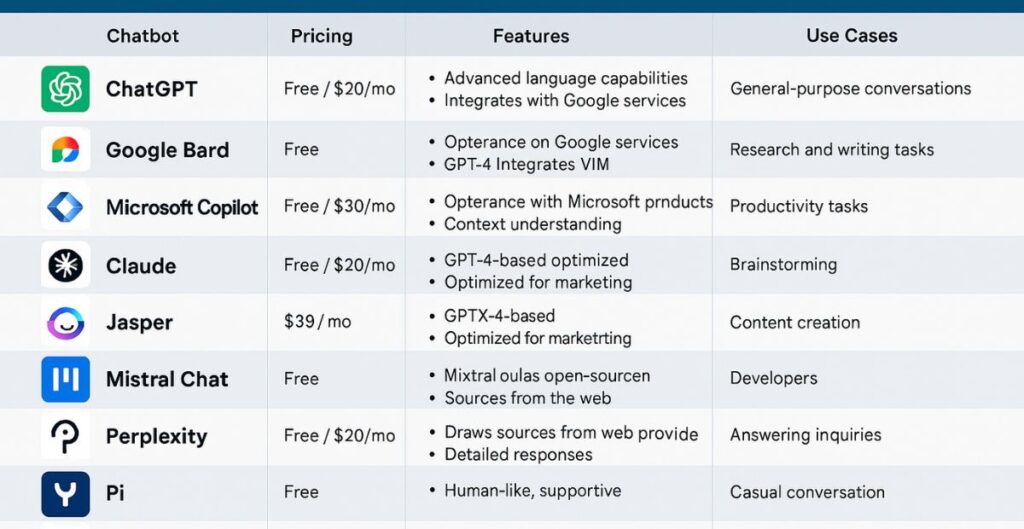

Best AI Tools for Crypto Arbitrage Trading in 2025

These are some AI-based platforms that traders utilize:

1. Pionex Arbitrage Bot

A well-liked platform providing in-built arbitrage bots supporting large exchanges.

2. Bitsgap

Supports AI-based trading automation with arbitrage scanning in real-time.

3. Haas Online

Sophisticated AI bots with scripting for custom arbitrage strategies.

4. Coin rule +

Simple AI trading automation for beginners with arbitrage support.

5. Arbi Smart

Specialized in AI-based arbitrage with robust risk management capabilities.

(Note: Always conduct your own research before investing in any tool.)

How to Start with AI Crypto Arbitrage Trading

If you’re new, follow these steps:

Choose a Reliable AI Tool – Pick one with proven results and good reviews.

Set Up Exchange Accounts – Register on multiple exchanges for better arbitrage opportunities.

Fund Your Accounts – Deposit crypto to start trading.

Customize Settings – Define risk tolerance, trade size, and strategies.

Run in Demo Mode First – Many platforms offer test trading without real money.

Monitor & Tweak – Even with AI, keeping an eye on performance and tweaking settings is necessary.

Future of AI in Crypto Arbitrage

As crypto markets progress, so will AI technology. This is what will happen:

More efficient machine learning models for predictive accuracy.

Building with DeFi protocols for decentralized arbitrage.

Reducing latency trades with block chain-based AI execution.

Cross-chain arbitrage as interoperability increases.

AI regulation frameworks to promote compliance.

The confluence of AI and crypto is only becoming more powerful, and arbitrage trading will continue to derive benefits from these developments.

Final Thoughts

AI crypto arbitrage trading tools are revolutionizing how traders make money in unstable markets. With real-time tracking, automation, and learning adaptation, they can provide you with a serious advantage. They’re not a magic money machine though—you still require strategy, risk control, and ongoing learning.

If you wish to remain competitive in 2025 and beyond, think about adding AI arbitrage tools to your trading arsenal. They could be the one thing that gives you the edge you’ve been seeking. –

If you’re serious about using AI tools for crypto arbitrage trading, it helps to sharpen related skills. For instance, check out the AI Writing Time Calculator to estimate how long it takes to create effective trading alerts or reports. Also, the post on 10 Game-Changing AI Explainer Tools can help you simplify complex strategies and show them visually—to clients or teammates. And if you want your blog posts or signals to be crystal clear, the Free AI Readability Checker is perfect for ensuring your content (or your trading strategy write-ups) can be understood even by someone new to crypto.